The latest IPAF Rental Market Reports analysis

July 17, 2023

Matt Brereton, IPAF’s communication manager, weighs up IPAF’s latest Rental Market Reports covering Europe, US and China.

In 2022, both the European and US mobile elevating work platform (MEWP) rental markets boomed to exceed pre-pandemic levels – though some key indicators such as rental and utilisation rates have yet to return to levels seen in 2019.

Uncertainty around high inflation and the ongoing conflict in Ukraine cloud the outlook for 2023-24, according to the latest analysis conducted for the International Powered Access Federation (IPAF) by Ducker.

MEWP rental market rebounds

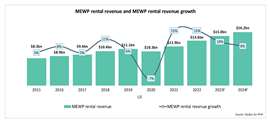

The European MEWP rental market reached €3.2 billion total revenue, driven by rental companies investing in their fleet, catching up on renewal and expansion plans that were hampered by supply-chain issues and limited availability of some new machines from manufacturers, the 2023 IPAF Rental Market Report indicates.

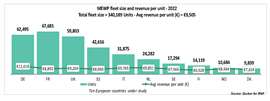

The European fleet stood at approximately 340,000 units at the end of 2022. Most European markets under study experienced elevated levels of growth and rebounding activity in both construction and non-construction sectors.

Overall, the European MEWP rental market grew by 8%, with Spain (12%), France (9%), the Netherlands and Italy (both 8%) showing the highest levels of growth, while the four Nordic countries (Denmark, Finland, Norway and Sweden) showed 4% growth.

The total rental MEWP fleet size in the 10 European countries under study was estimated to stand at approximately 340,000 units as of the end of 2022.

In 2022, on the back of the strongest growth out of the 10 European countries under study, France kept its position as having the largest MEWP rental fleet, exceeding 67,000 units after growing by approximately 5,000 units.

Second in terms of size was the German fleet, at close to 62,500 units, followed closely by the UK fleet, at almost 60,000 units (low-level access units excluded).

Average revenue increased to €9,505 per unit and, as in previous years, Germany had the highest revenue per unit.

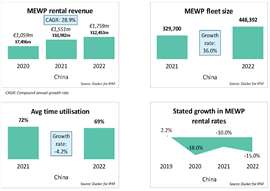

Across Europe, utilisation rate went up by 1% to an average of 65%, after a steep recovery in 2021, partly driven by limited availability and fleet expansion and partly by elevated demand. After a slower recovery in 2021, Spain saw utilisation rate increase by 3% during 2022.

Aerial platform rental rates on the rise

With unprecedented market demand and both inflation and MEWP purchase prices rising, rental companies were forced to substantially increase rental rates in most European countries, leading to an average rise of around 4% in 2022.

Only the Nordic region experienced challenges, owing mainly to consolidation activity, increasing already fierce market competition, which suppressed rental rate growth.

Levels of investment remained positive, increasing by 24% in 2022 compared to 2021. In addition to high demand, investment was driven by rental companies wanting to renew fleets and transition to greener technology. #

Market outlooks remain positive, as manufacturer lead times are expected to reduce over the next 12-18 months and rental companies forecast continued healthy demand and revenue increases, driven by rental rate rises to offset the effects of inflation and input-cost pressures.

US access equipment rental market

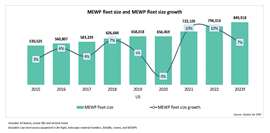

The report indicates that 2022 was also a year of rapid growth in the US; with both the wider economy and construction activity at elevated levels, most main indicators returned to pre-pandemic levels or even exceeded them.

MEWP rental revenue reached a record high, a direct consequence of the country’s rapid market growth, rising by 15% to reach US$13.6 billion. Total fleet size expanded, while rental companies were able to increase rental rates by an average of five per cent in 2022.

Utilisation rates increased to an all-time high of 73%, though these are expected to fall back once supply chain issues abate.

Rental market value grew 15% year on year and is expected to remain at these elevated levels over the next two years, owing to the US’s continuing strong economy. Rental revenue increased as a result of rental companies increasing rental rates and expanding fleet size in line with increasing demand in the market.

Demand is expected to remain high, though revenue growth is expected to slow down over the next few years owing mainly to decreasing demand.

US rental equipment fleet forecast

Overall, the US total fleet size increased by around 10% across 2022, adding more than 70,000 units to the country’s estimated total MEWP fleet. The US fleet is forecast to continue growing in 2023, sustaining record years of growth.

Wherever possible, MEWP rental companies expanded their fleet in 2022, owing to peaks in demand. The total number of units in the US MEWP fleet is expected to reach almost 850,000 units by the end of 2023.

Within the total US fleet, all MEWP categories saw similar increases in 2022, with the exception of particularly robust growth rates reported for spider/tracked lifts, owing to their versatility and suitability for use in tight spaces or on rough terrain.

Spider lifts are increasingly used in forestry, gardening, painting, and industrial cleaning. Overall fleet mix remained broadly the same as in previous years and is expected to remain relatively unchanged in years to come.

MEWP fleet retention

Owing to ongoing supply-chain issues, average retention period increased in the US, raising concerns about ageing fleets, which is expected to keep investment levels high in 2023.

As predicted in 2022’s report, high tariffs imposed on Chinese-manufactured machines restricted availability in the market, increasing purchase-price pressures.

US average rental rates increased by 5% in 2022 to compensate for the increase in MEWP procurement costs and inflationary pressures. Most companies expected further slower pace, as is it hard to sustain client relationships with high year-on-year increases.

Chinese equipment rental market

As in previous years, the report contains a special China Market Focus, which shows that in 2022, Chinese MEWP rental revenue grew by 13%, primarily driven by the expansion of rental company fleets.

However, both rental and utilisation rates decreased in 2022 owing to insufficient demand during recurring regional pandemic lockdowns and enduring fierce market competition, worsened by rapid fleet expansion.

With rental demand recovering in the first quarter, utilisation is expected to rise again in 2023 from the lows experienced during the peaks of the pandemic.

■ For detailed analysis of European, US and Chinese markets, the 2023 IPAF Rental Market Reports are available now. IPAF manufacturer, supplier, distributor and rental company members can apply for a free copy of the relevant report by filling in the form at www.ipaf.org/reports; non-members are able to purchase the report.

STAY CONNECTED

Receive the information you need when you need it through our world-leading magazines, newsletters and daily briefings.

CONNECT WITH THE TEAM