Crane rental industry analysis

28 June 2022

Comprehensive analysis of the world’s largest mobile crane fleets is available in an in-depth report from Off-highway Research. ICST reports.

A study carried out in partnership between specialist market research and forecasting company Off-Highway Research and this magazine sheds new light on the development, size and composition of the world’s largest mobile crane fleets.

The report was produced as a collaboration between Off-Highway Research and ICST

The report was produced as a collaboration between Off-Highway Research and ICST

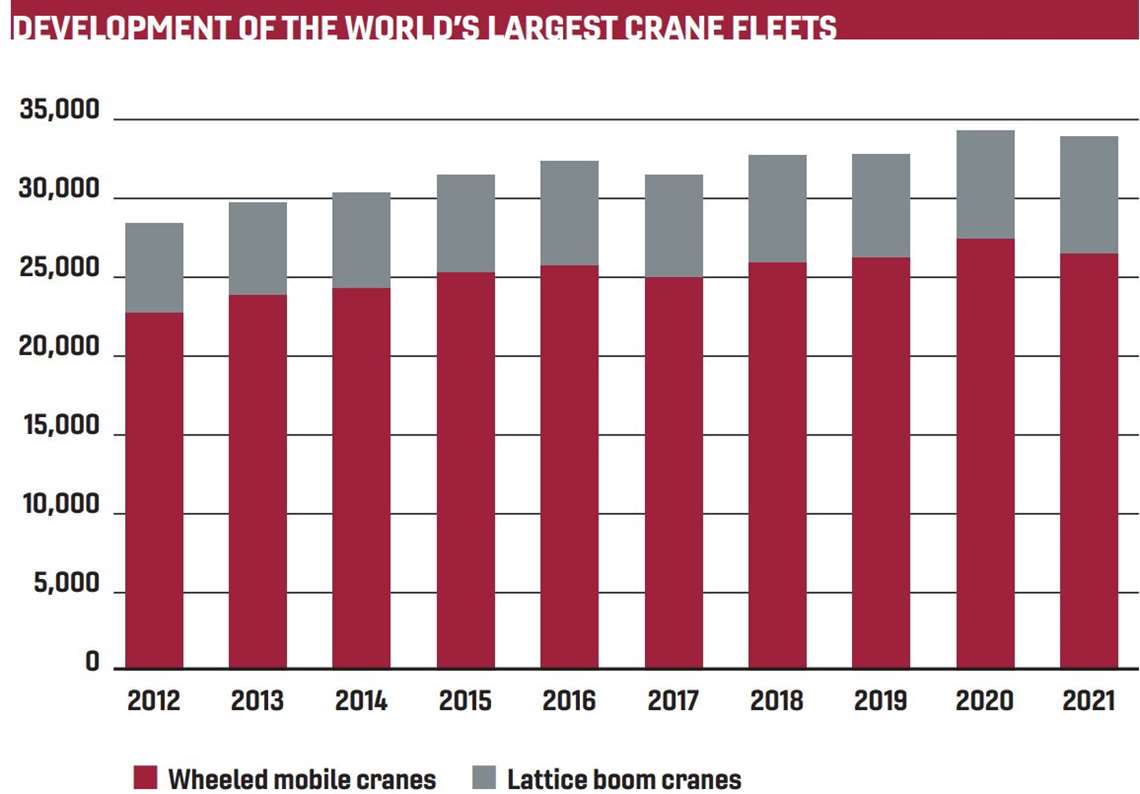

Based on a multi-year analysis of ICST’s IC50 (now IC100) league table of the world’s largest crane-owning companies, Global Mobile Crane Fleets looks at how crane numbers and lifting capacities have changed over the years.

The IC100 is based on the total load moment of each company’s fleet in tonne-metres. Companies listed in the rankings have an IC Index from 42,600 tonne metres at the bottom to more than 3.5 million for the first-placed company. Fleet sizes vary from around 50 cranes for the smallest companies to 3,365 for the largest fleet (in unit terms) in the ranking.

In the 2021 table, seven IC100 companies had a fleet of 1,000 cranes or more. The average load moment per crane for

IC100 companies was 888 tonne metres in 2021. This equates to a 296 tonne capacity wheeled crane or a 178 tonne capacity crawler. Companies in the IC100 can also generally be split into those focusing on the heavy lift applications, which generally have fewer heavier cranes, or those more in the mass market, which have larger fleets of relatively lighter machines.

This can be discerned by their average IC Index per crane and its variance from the global average. Having said that, there is a clear trend for almost all IC100 companies to move to heavier lift cranes over time.

This is observed in the growth of the total IC Index, which has doubled over the last decade, compared to only a 19 per cent rise in the total number of cranes owned. The trend is also illustrated by the average lifting capacity of the largest crane in each fleet, which has risen from 800 tonnes twenty years ago to more than 1,200 tonnes in 2021.

Metrics derived from the IC100 indicate relative stability, compared to the global crane market as a whole. However, whereas the cyclical mobile crane market tends to swing up or down by 10 per cent or more per year, changes in the IC100 fleet are more modest, moving by single digit amounts each year. There is a correlation between growth in the IC100 fleet and GDP growth.

What is in the Global Mobile Crane Fleets report?

At more than 100 pages, Global Mobile Crane Fleets is a unique analysis of the worldwide crane rental industry, charting its development over more than a decade. Sections include an analysis of the global market for cranes, which is tied to metrics from the IC100, including changes in load moment, number of cranes, fleet composition, and staff and employee numbers.

This provides insights into how the world’s largest crane companies – which in 2021 owned a combined fleet of almost 34,000 cranes – develop their fleets and position themselves in the market.

Evolution of the world’s 100 largest wheeled and crawler crane fleets. Units are number of cranes. (Photo: Off-Highway Research and International Cranes and Specialized Transport)

Evolution of the world’s 100 largest wheeled and crawler crane fleets. Units are number of cranes. (Photo: Off-Highway Research and International Cranes and Specialized Transport)

It will be of interest to crane manufacturers and other suppliers to the lifting industry as they seek to understand their largest customers, as well as to crane rental companies themselves which wish to benchmark their businesses against competitors and look for new opportunities in the market.

For buying options see: https:/offhighway-store.com/ or contact: [email protected]

MAGAZINE

NEWSLETTER

The gold standard in market research

Off-Highway Research offers a library of more than 200 regularly updated reports, providing forensic detail on key aspects of the construction equipment industry.

Our detailed insights and expert analyses are used by over 500 of the world’s largest and most successful suppliers, manufacturers and distributers, to inform their strategic plans and deliver profitable growth.